In Summary

- The deterioration of

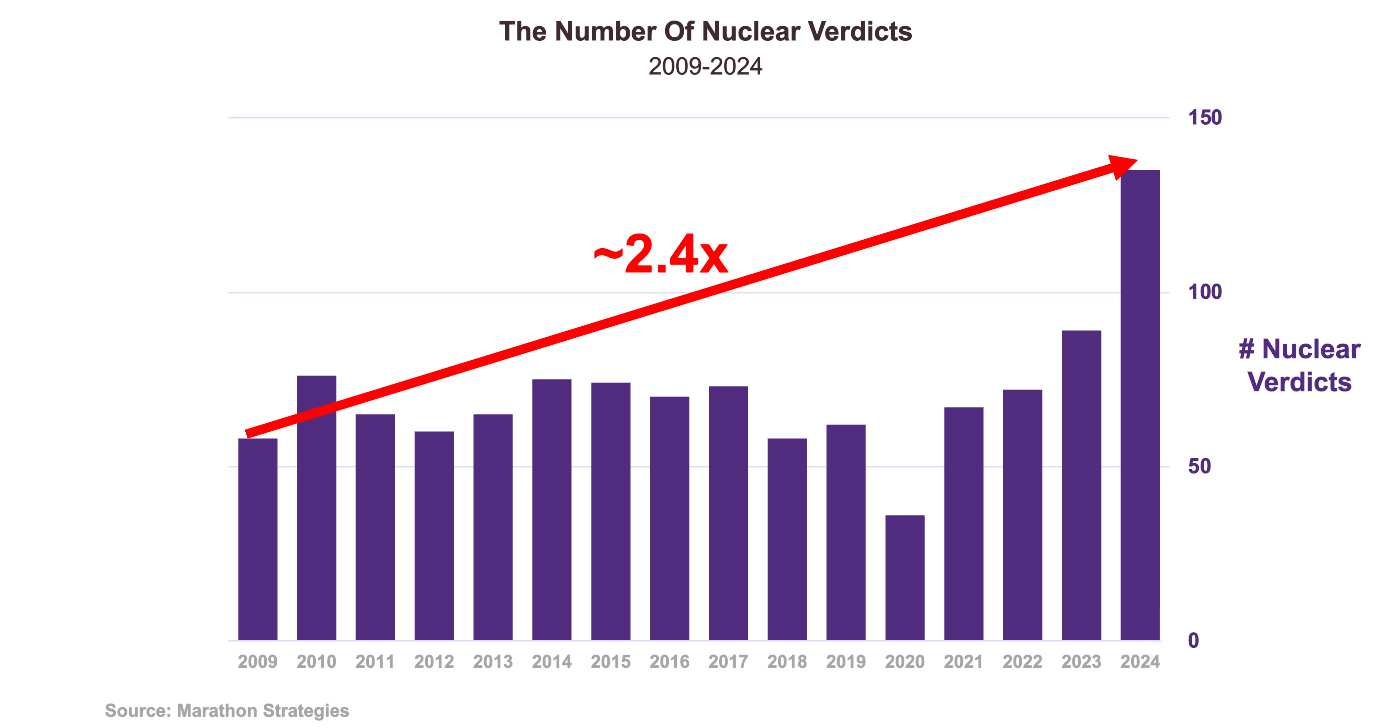

2015-2019continues. Despite actions taken, the number of underperforming years continues to expand. - Nuclear verdicts continue to proliferate

- Market sentiment (orderly) is at odds with claims management (anything but orderly)

- Carriers face difficult decisions

- Is a change of policy coverage in order?

Last year we laid out the causes and consequences of the deterioration in U.S. casualty results. While the full and final extent of our soft market sins remain vague, it is clear the problems are both deeper and broader than the market was willing to recognize.

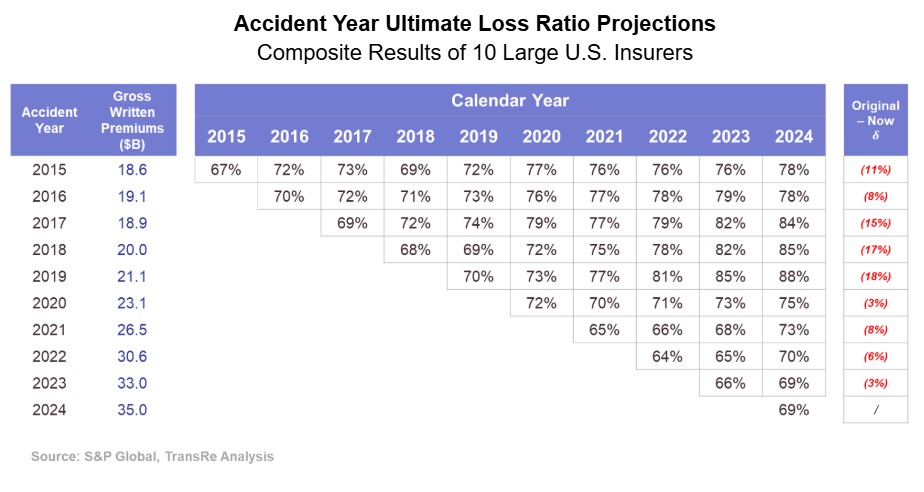

We start with an update of our composite of the ten largest writers of U.S. casualty, to compare projections at the end of 2024 against the end of 2023:

Despite all the cumulative effort on pricing and limits, the collective results continue to weaken.

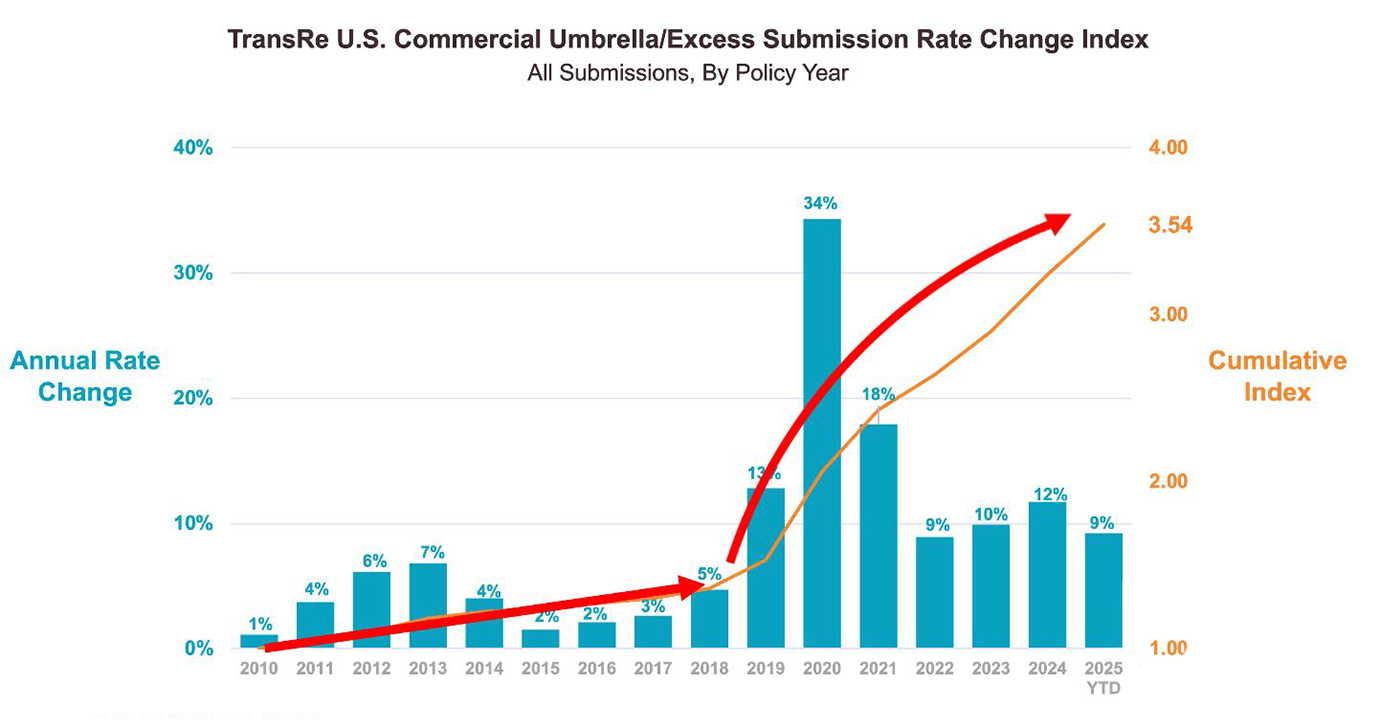

To better understand the drivers, we developed a rate index, based on the commercial umbrella and excess submissions we receive. The index represents ~$150B of cumulative premium since 2010.

We have included all business priced (not just business we wrote, figures are weighted by subject premium, and it includes some assumptions for the latest year):

Clearly, the market recognized it had an issue, and took corrective action. But if the overall projections continue to deteriorate, the corrective actions start to look inadequate.

“While companies thought, at the time, pricing was ahead of loss trend, with hindsight it appears (at best) the industry was keeping up with trend and more likely falling behind. (Dowling, March 2025).“

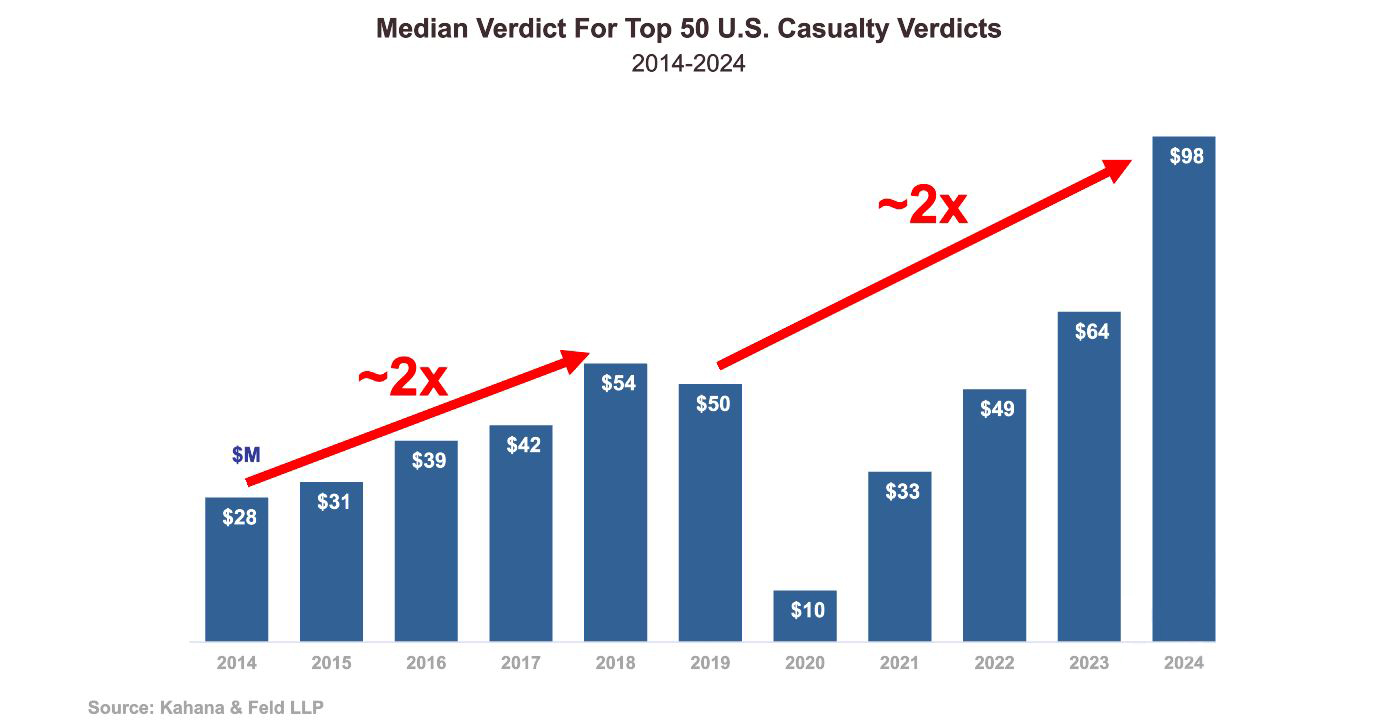

Turning to losses, we note two returns-to-trend (or reversions to mean):

a) the number of reported nuclear verdicts (frequency)

b) the median amount of those verdicts (severity)

With nuclear awards becoming common place and jurors desensitized to the impact, it takes a truly shocking award to make any kind of ripple, let alone a wave.

In a lottery, the delight of a very few is paid for by the small change of the many. In effect, U.S. jurors have created their own state lotteries, paid for by every small business and consumer insured (including themselves). A further and potential unintended consequence, is to line the pockets of wealthy, offshore litigation funds that have emerged to create a new ‘asset’ class.

“Our legal environment is draining family bank accounts and hurting job creators of all sizes in nearly every industry in our state“ Brian Kemp, Georgia State Governor (Jan 2025).

In an effort to stem the tide, some U.S. states have proposed and/or enacted reforms designed to slow the ever-escalating cost of claims. While we wish them every success, it will be some time before we will see the fruits of their labors in the numbers.

In the meantime, we have a market to navigate. We see genuine effort to stem the losses with limit caps and rate increases, but our annual rate change tracker has dropped into single digits for this year so far, despite all the loss inflation factors (bad faith accusations, skilled attorneys, juror sentiment) still firmly in place.

Time for a change?

Casualty policies may be written with three different loss triggers: losses occurring during (most common), occurrences reported during (the ‘Bermuda Form’) and claims made (predominantly used for high risk products liability such as pharmaceuticals etc).

Writing policies on a losses-occurring basis creates significant tail risk. To reduce/shorten that potential drag on re/insurance results, is now the time to offer a ‘new/old’ product and switch to writing U.S. casualty on a claims made basis? The recent launch of such a facility, supported by three market-leading insurers, is a good start. Claims made policies give re/insurers the ability to respond more quickly to changing market conditions. To improve long-term industry results, the changeover requires traction and we encourage every carrier and broker to support this initiative.

All policy forms have complexities – for example the Bermuda Form (Occurrences Reported) uses an integrated occurrence to attempt to limit the losses from the same event, condition, cause, defect, etc. to one policy year. Despite being in existence for some considerable time, this can still lead to coverage disputes.

Claims made policies require the occurrence to have taken place after the applicable retroactive date (to avoid open-ended cover). If an insured switches from losses occurring to claims made, the retroactive date should be the same as the inception date of the claims made policy, to avoid any potential recovery on both policies. A claims series clause may help limit potential claims to one policy year, yet the clause must be sufficiently broad to encompass all claims from the same cause (similar issues to the Bermuda Form). That may increase the severity, but it also limits the claim to one policy year/one limit.

In conclusion

Beyond implementing significant rate increases and resetting limit utilisation, it is difficult to see what else the market might do on a losses-occurring basis. Risk selection is a key factor, but risks need to find homes at fair prices.

Other casualty lines have switched to claims made. The transition might not be seamless, but it would leave the market better positioned to face future challenges. We therefore await news of progress with interest.

In the meantime, as we continue to count the true cost of earlier sins, we believe underwriter differentiation is key to future success. We remain committed to those who demonstrate the ongoing vigilance and discipline required to succeed.

Contacts

Legal

Reproduction in any form without permission of TransRe is prohibited.

The material and conclusions contained in this document are for information purposes only and TransRe offers no guarantee for the completeness of its contents.

Statements in this document may provide current expectations of future events based on certain assumptions. These statements involve known and unknown risks, uncertainties and other factors which are not exhaustive. Although TransRe makes reasonable efforts to obtain information from reliable sources, TransRe does not guarantee the accuracy or completeness of the information given or any forward-looking statements made.

TransRe undertakes no obligations to revise or update any statements, whether as a result of new information, future events or otherwise, and in no event shall TransRe or any of its affiliates or employees be liable for any damage or loss arising in connection with the use of the information relating to this document.