U.S. D&O Insurance Market

September 2025 Update

We have added two quarterly data points to our primary price analysis. Fewer policies are renewing with decreases. However, increases are still difficult to achieve:

For each section, we look at the # policies renewing up, down or flat.

Note – our price indices do not (and cannot) capture changes in terms or conditions. This is particularly important for Private Companies, where coverage is broadening.

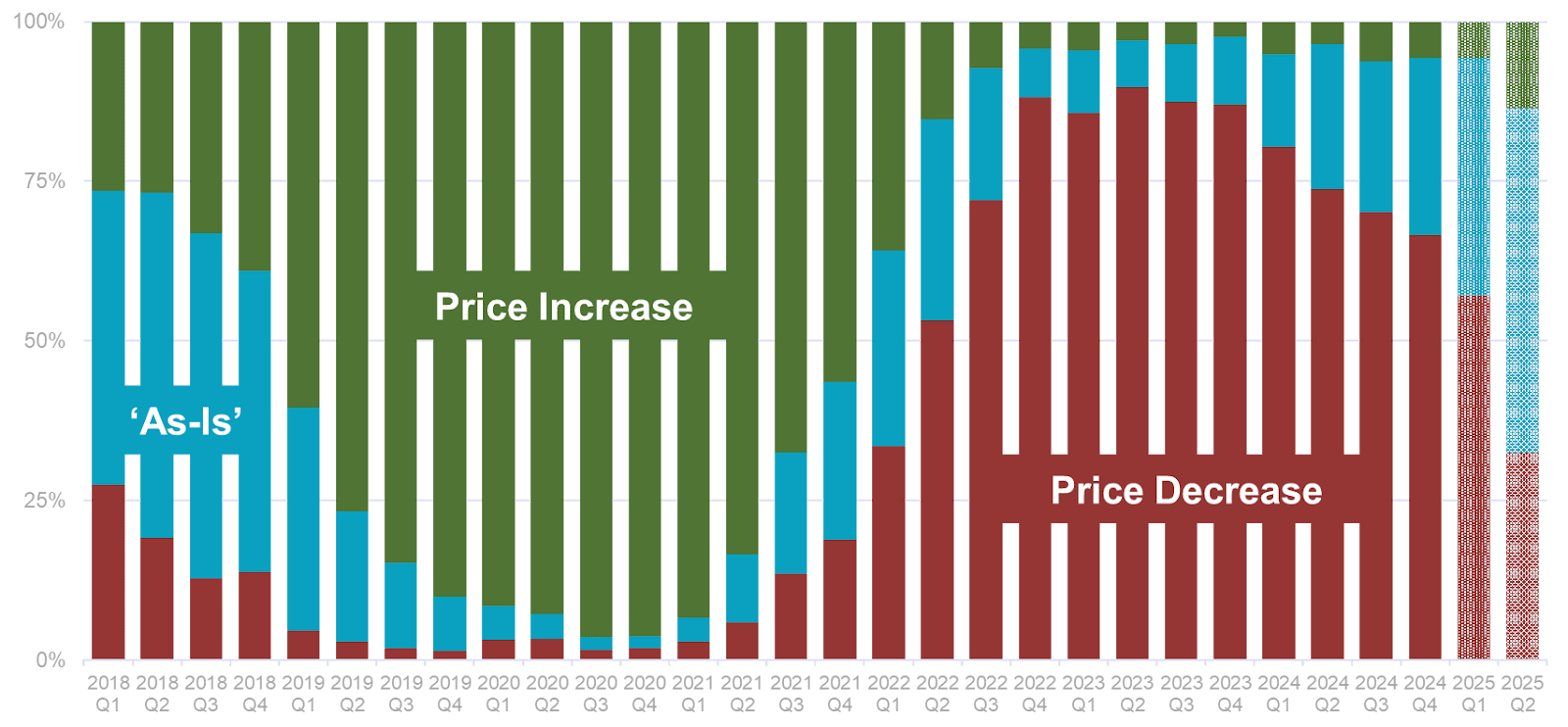

Commercial Public Companies

Renewal Price Outcomes by Policy Count

The number of policies renewing with a price decrease is dropping, and the overall average price change is moving back towards flat. However, given the year-on-year price decreases that preceded 2025, and the general outlook, we do not believe the ‘fight for flat’ is sufficient at this stage.

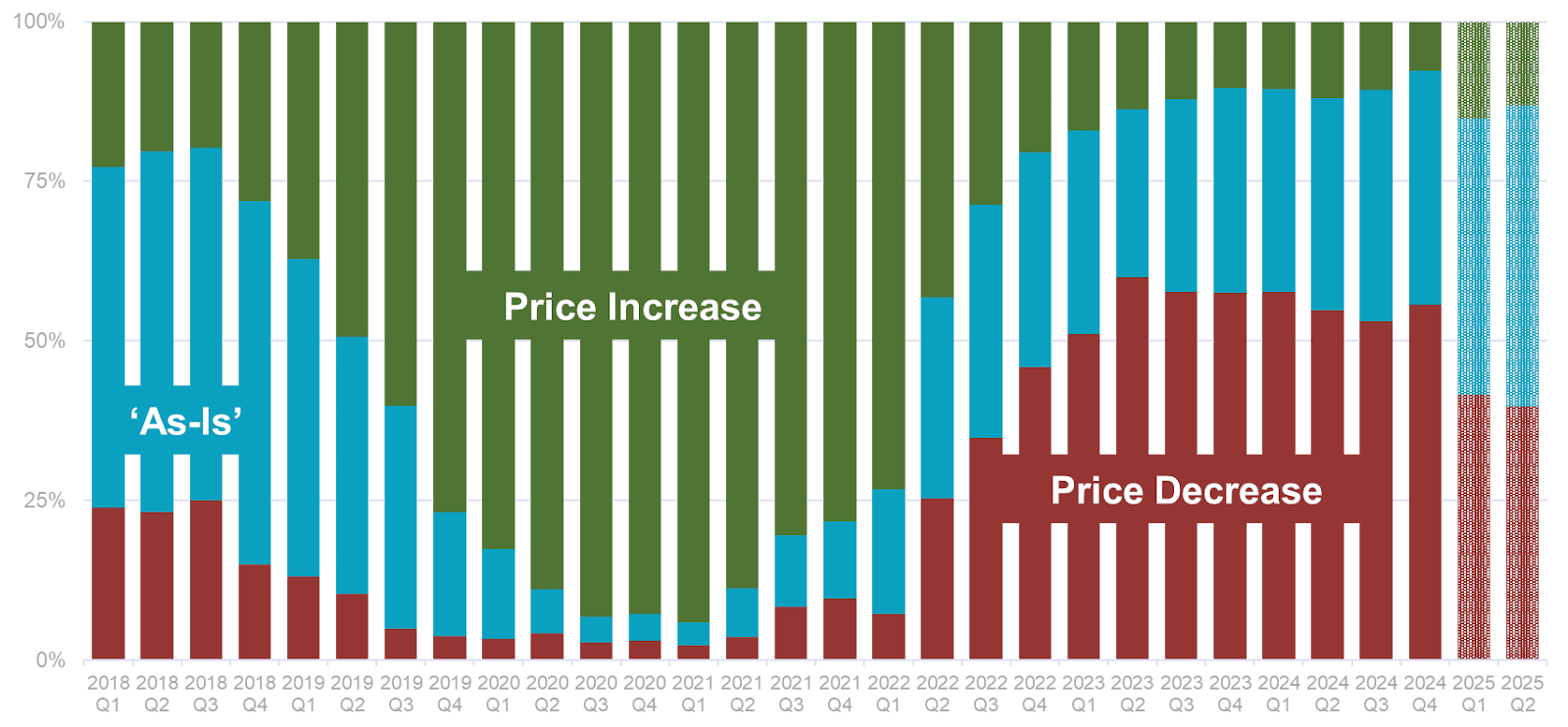

Financial Institutions

Renewal Price Outcomes of Policy Count

Over half of FI policies renewed flat or up, but actual price rises are thin on the ground. Although the FI pricing environment is less volatile than for public commercial, over the past four quarters the average decrease has been 8%.

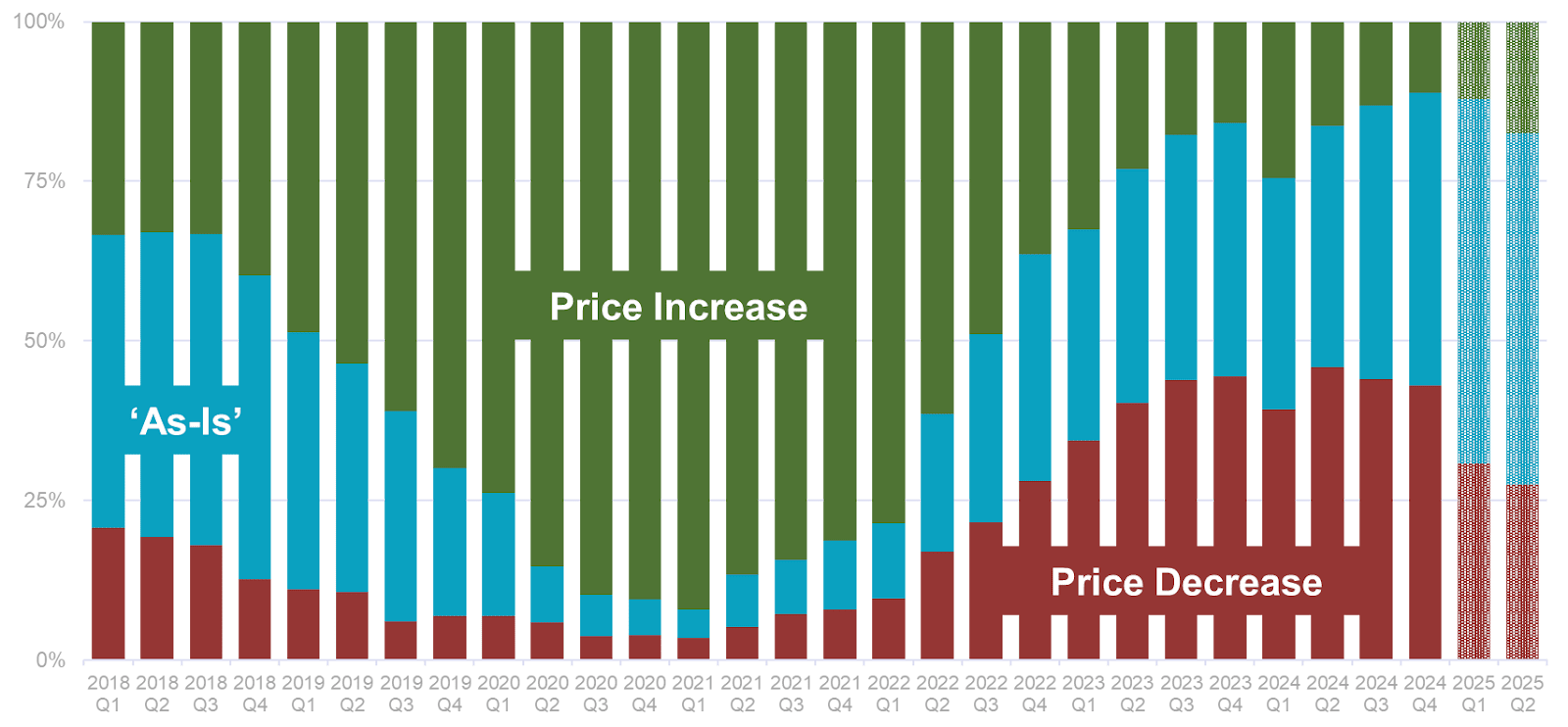

Private Companies

Renewal Price Outcomes of Policy Count

With the right underwriting infrastructure and an expert claims team, private company D&O can be underwritten profitably. However, we have also seen the impact of capacity moving from public companies to private – over the past four quarters, the average price reduction has been 10%.

Claims

Cornerstone reports continued elevated levels of core (ex M&A) Securities Class Action filings in the first half, above the historical average. More importantly, significant YoY increases in Disclosure Dollar Loss (+56%) and Maximum Dollar Loss (+154%) mean current pending securities class actions are likely to settle for ever higher amounts.

There is no reason to expect private companies will be less affected by the ongoing rise in corporate bankruptcy filings.

In 2015-2019 the market was worried about frequency. Today the rapid rise in DDL/MDL levels means severity is much more of a concern.

Contacts

To discuss any aspect of this update, or your ongoing U.S. Public D&O reinsurance needs, please reach out to any member of the production team:

Portfolio Management

Elise McKenzie

Anthony Matteo

Ben Casey

Underwriting

Daniel Hojnowski

George Delaney

William Seymour

Mathew Yuen

Dierdre Zeppie

Lonny Agulnick (Fac)

Actuarial

Joe Marracello

Kevin Peterson

Claims

Seth Goldberg

You can also reach us at Communications@transre.com.

Legal

Reproduction in any form without permission of TransRe is prohibited.

The material and conclusions contained in this document are for information purposes only and TransRe offers no guarantee for the completeness of its contents.

Statements in this document may provide current expectations of future events based on certain assumptions. These statements involve known and unknown risks, uncertainties and other factors which are not exhaustive. Although TransRe makes reasonable efforts to obtain information from reliable sources, TransRe does not guarantee the accuracy or completeness of the information given or any forward-looking statements made.

TransRe undertakes no obligations to revise or update any statements, whether as a result of new information, future events or otherwise, and in no event shall TransRe or any of its affiliates or employees be liable for any damage or loss arising in connection with the use of the information relating to this document.