“Recognize reality even when you don’t like it – especially when you don’t like it.”

Charles Thomas Munger (1924-2023)

OUR VIEW

We have argued in favor of immediate & significant price rises:

- Rationalizations for current prices, which include new capacity, rate adequacy, investment yields, and fewer class actions, are as unconvincing as ever

- Insurers are currently ‘‘fighting for flat’. They are losing.

- There is no upward momentum

- We are not operating in a risk-free macroeconomic environment

Today’s U.S. Public D&O insurance market is, in the aggregate, unprofitable.

SUPPORTING DATA

Our view is built on four interconnected perspectives:

1. Price changes

2. Renewal retention rates

3. Loss ratios

4. Loss drivers

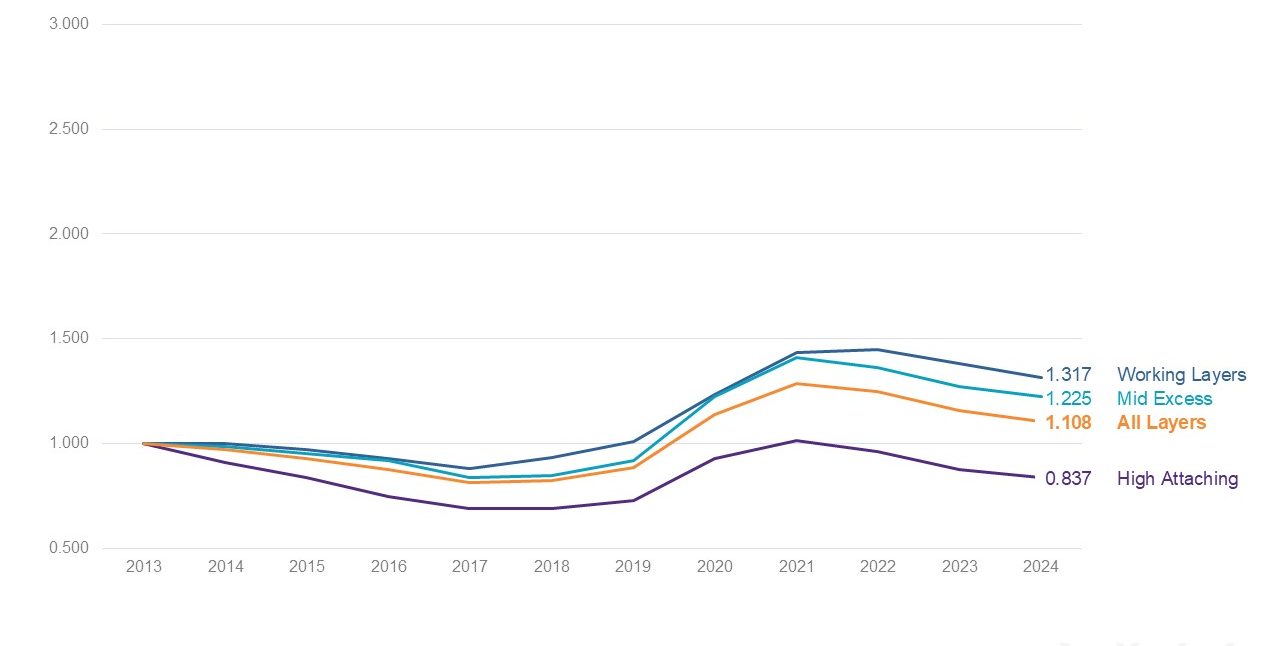

1. PRICE CHANGES

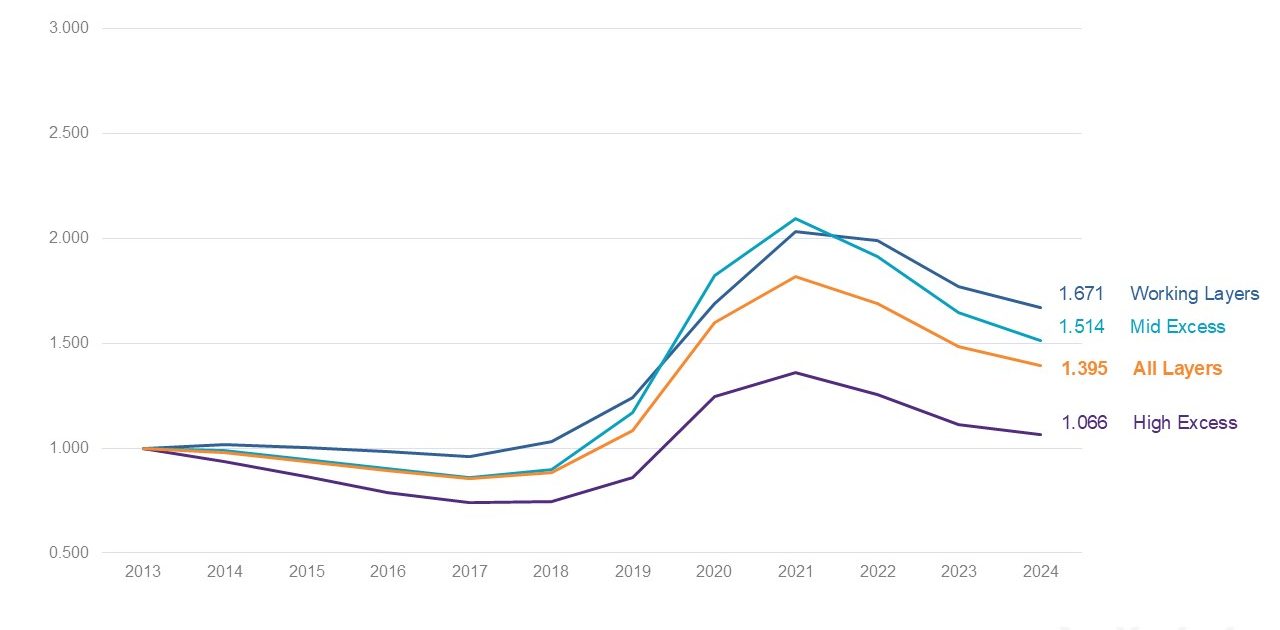

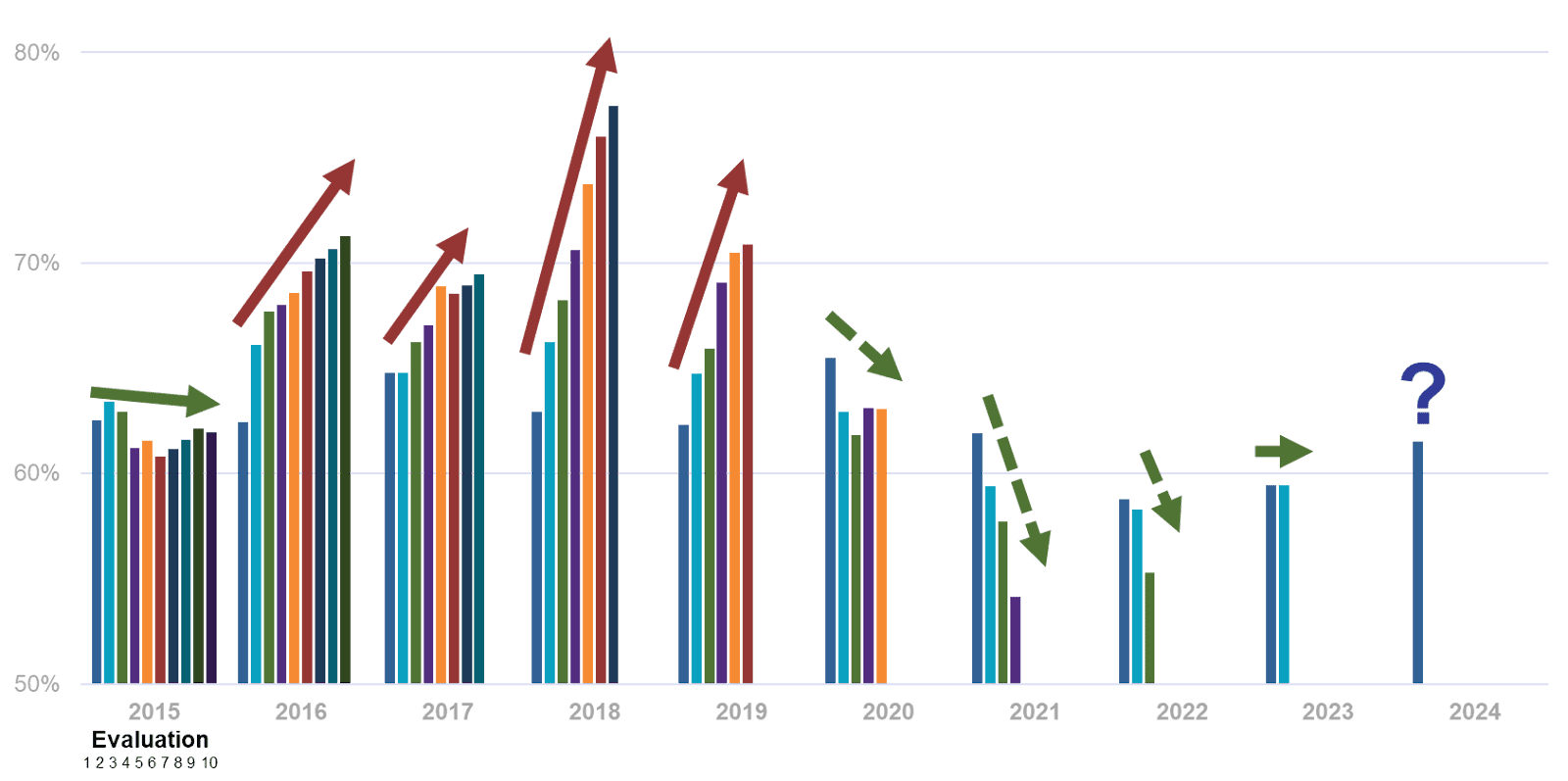

We start with the annual change in prices by attachment bands:

Note: we have excluded (where identifiable) IPO/SPACs/DeSPAC data from our price change exhibits to avoid the rapid increase and decrease of these high-premium programs from unduly affecting more general trends.

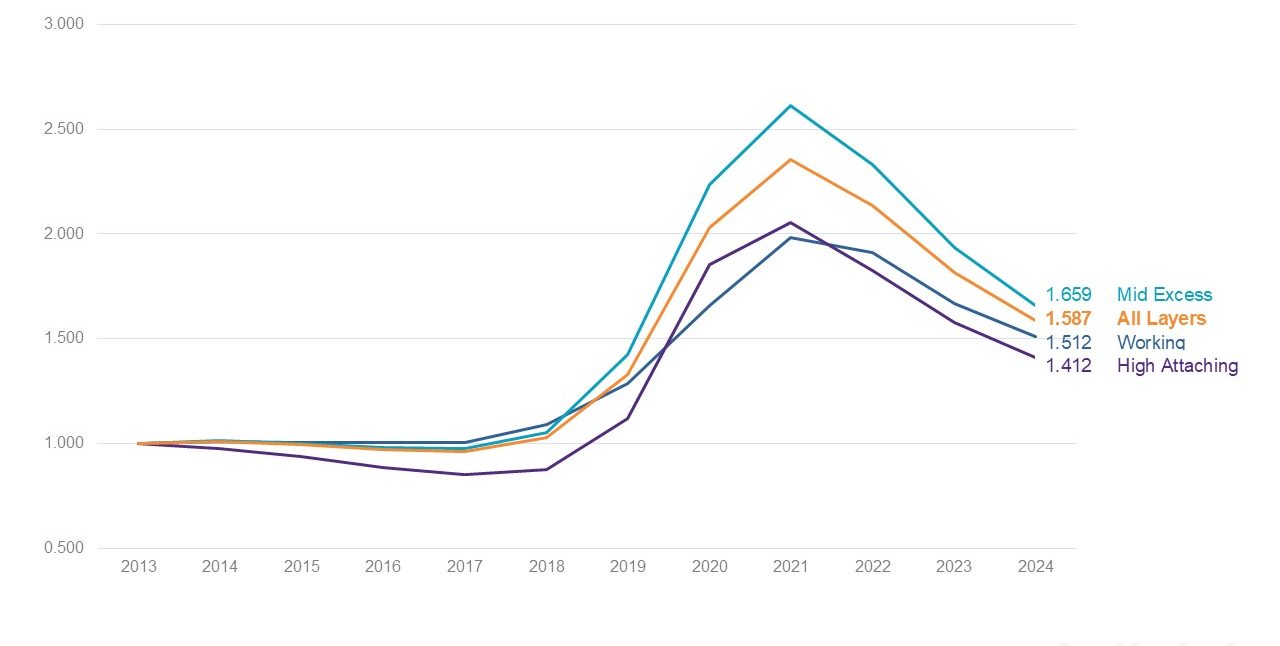

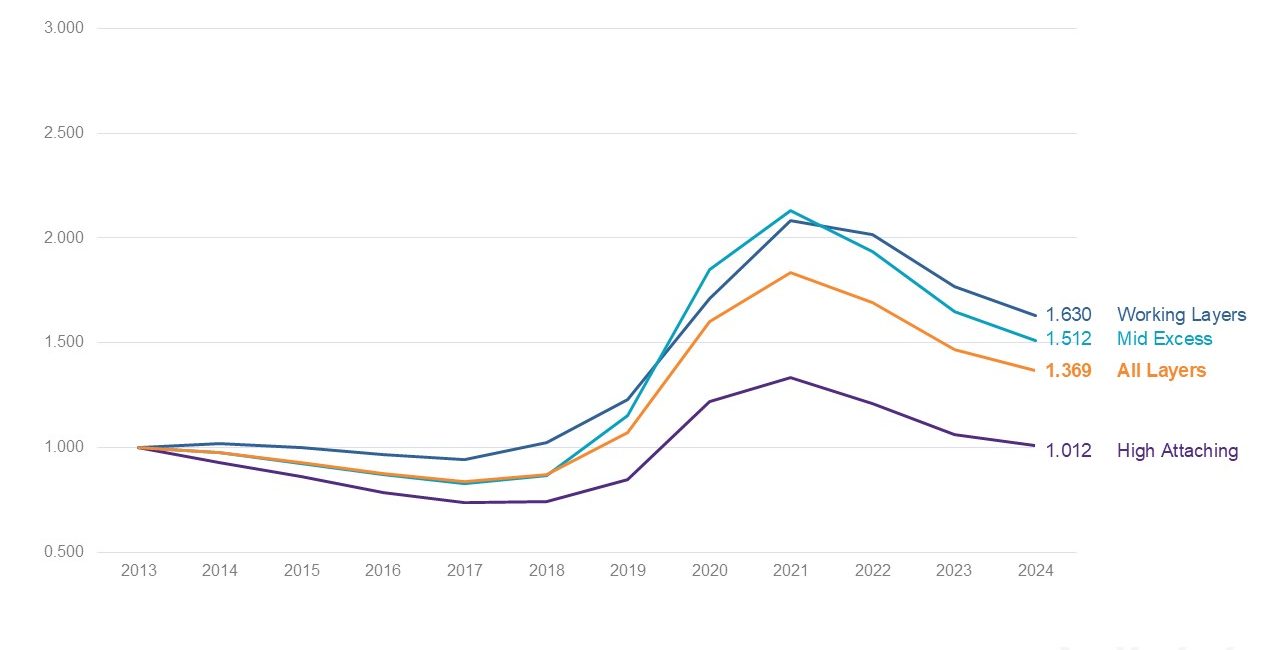

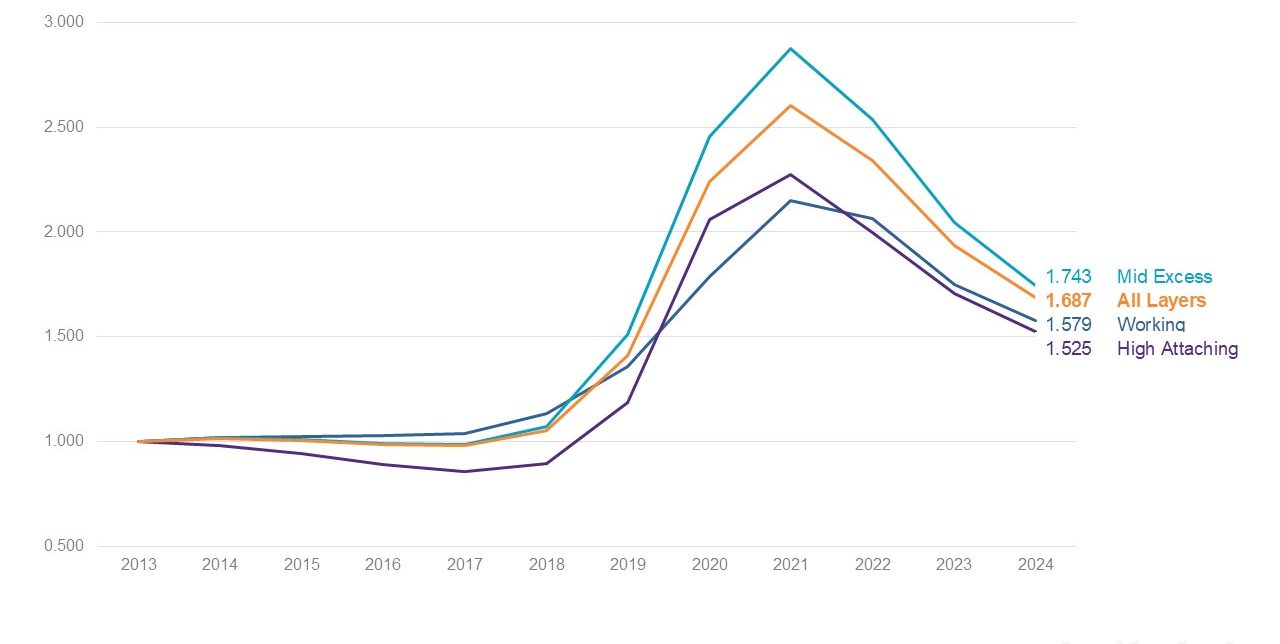

TransRe U.S. Public D&O Insurance Price Index

All Policies By Layer, 2013-2024

- The speed of reductions slowed in 2024 but prices continue to fall

- These are nominal changes, before adjusting for increased loss cost trends

- High excess layers are +6.6% since 2013. During that period the S&P500 has more than tripled as (by definition) has the average capitalization of each constituent company.

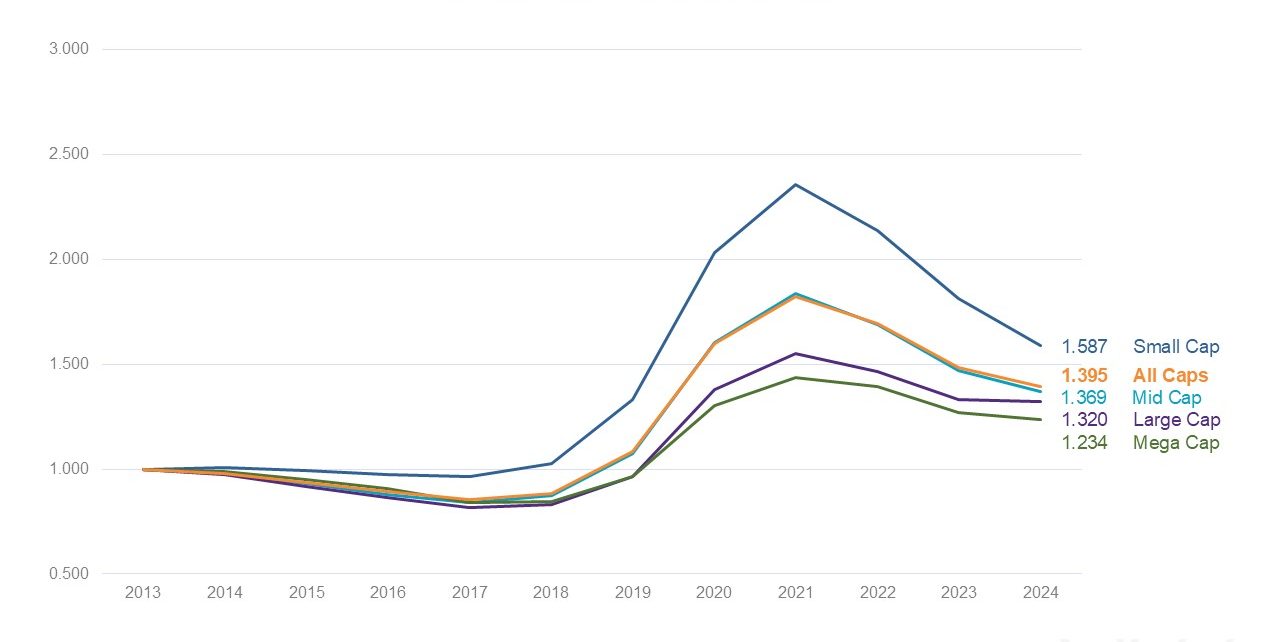

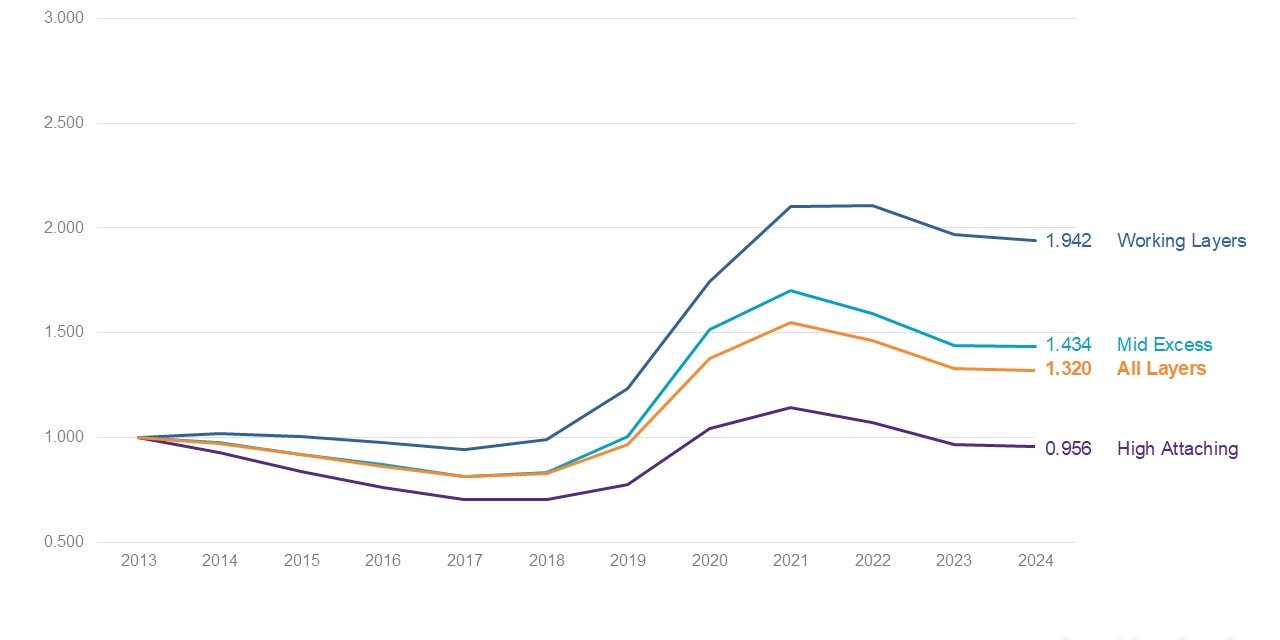

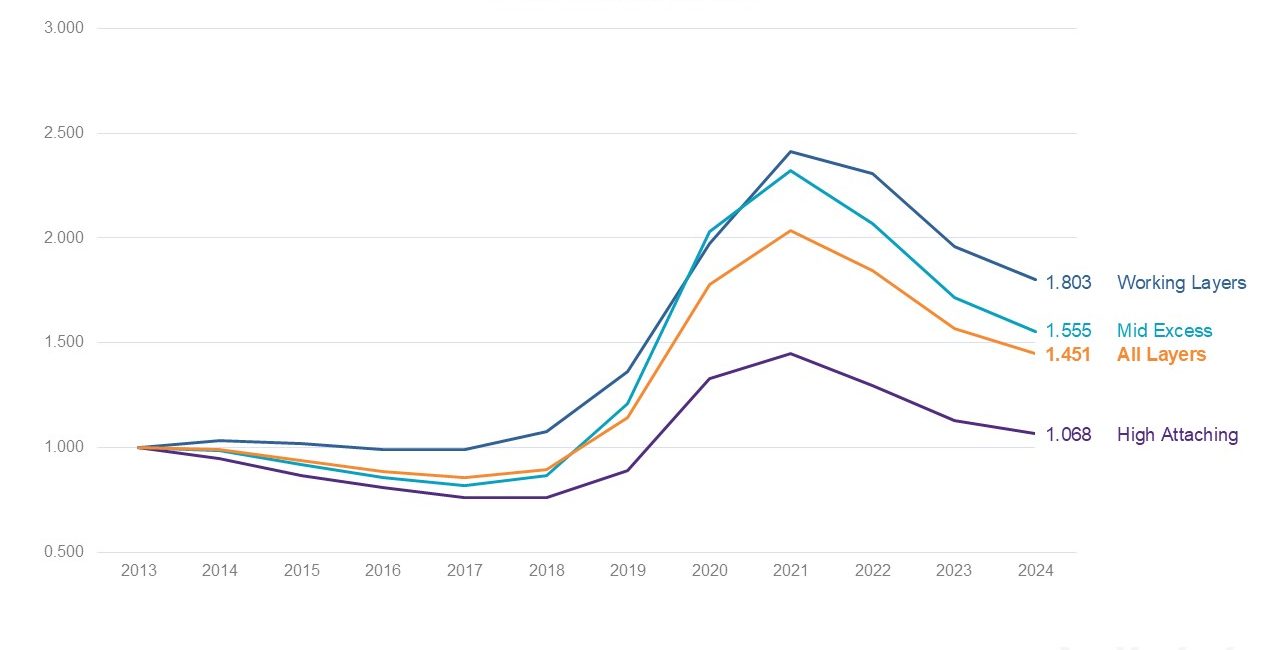

Then we split the data by size of insured:

TransRe U.S. Public D&O Insurance Price Index

All Policies By Insured Market Cap, 2013-2024

- Easy come, easy go? – small cap prices rose furthest, have fallen back fastest, and continue to do so

- Large cap prices are less volatile – they remain at higher risk of securities class actions

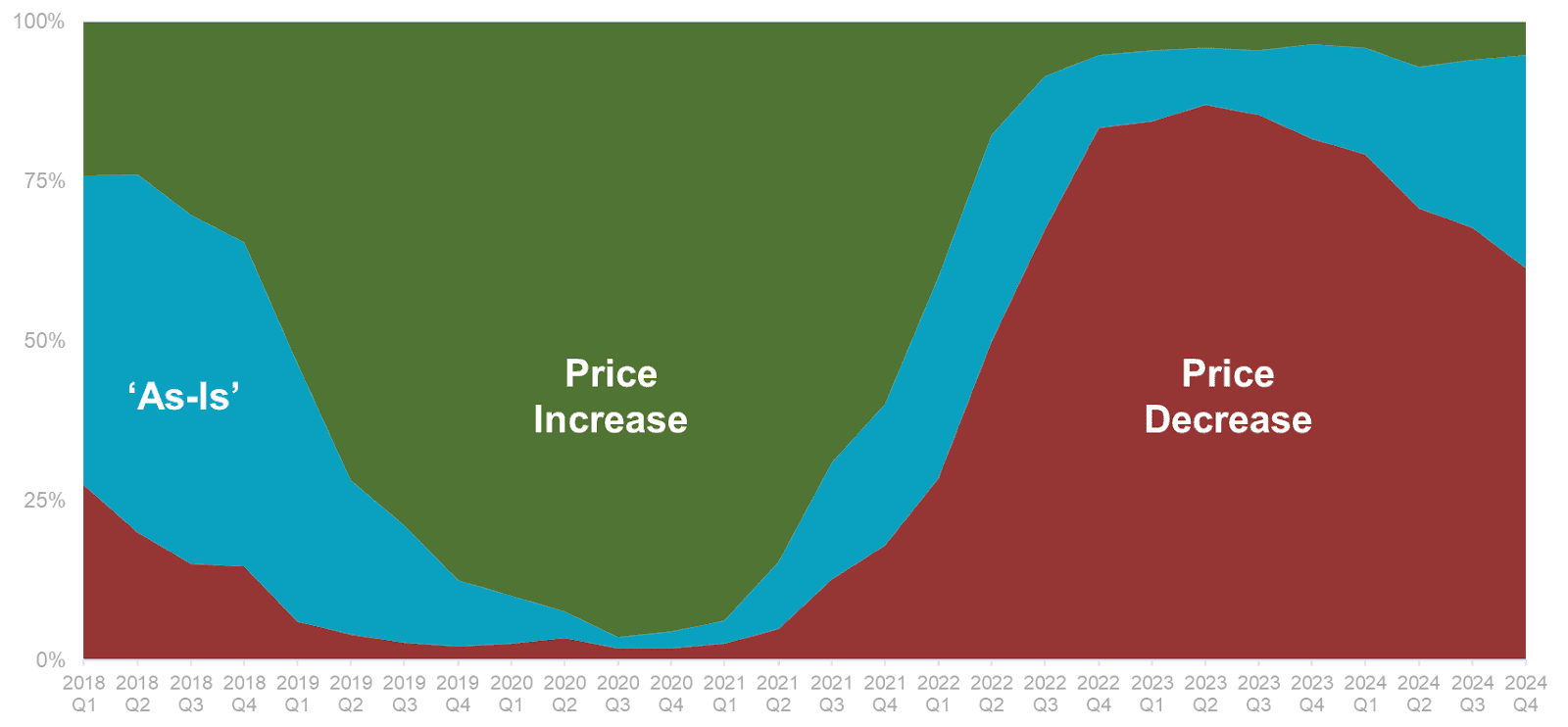

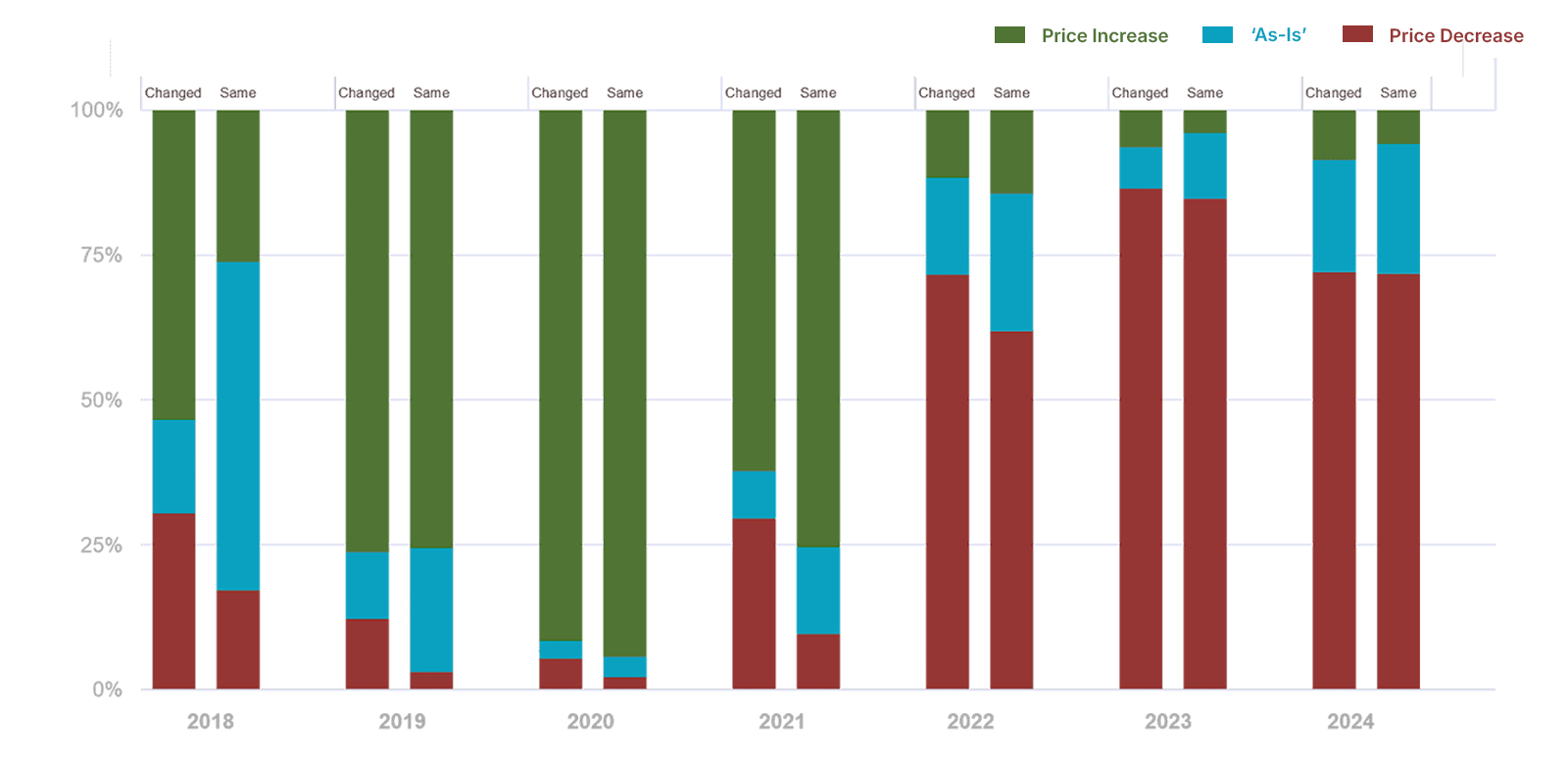

Changing to a quarterly view, we mapped all policies by whether they renewed up, down or flat:

Price Outcomes Of Renewing Policies

All Companies, 2018 – 2024

- In Q1 2018, among policies with price decreases, the average change was -8%

- By Q1 2023, when many more policies renewed down, that average change was -19%

- Although more policies have renewed flat recently, very few have renewed up, and more than three of every five policies continue to renew with price reductions

We compared how much prices have increased or decreased within each category:

Quantum Of Price Change

All Policies, 2018 – 2024

- In mid-2020, when most policies were renewing up, they were also renewing significantly (50%+) up (‘the necessary correction phase’)

- The market turned and as more policies renewed down, so the overall average change dropped dramatically. Q4 2024’s overall average price reduction was still at -3.9% (the ‘irrational group-think’ phase).

- The only insureds to see price rises are those who have reported a claim or have had some concerning developments. If everyone else’s price is dropping, insurers are clearly struggling to differentiate

The trajectory of price changes is insufficient to sustain profitability.

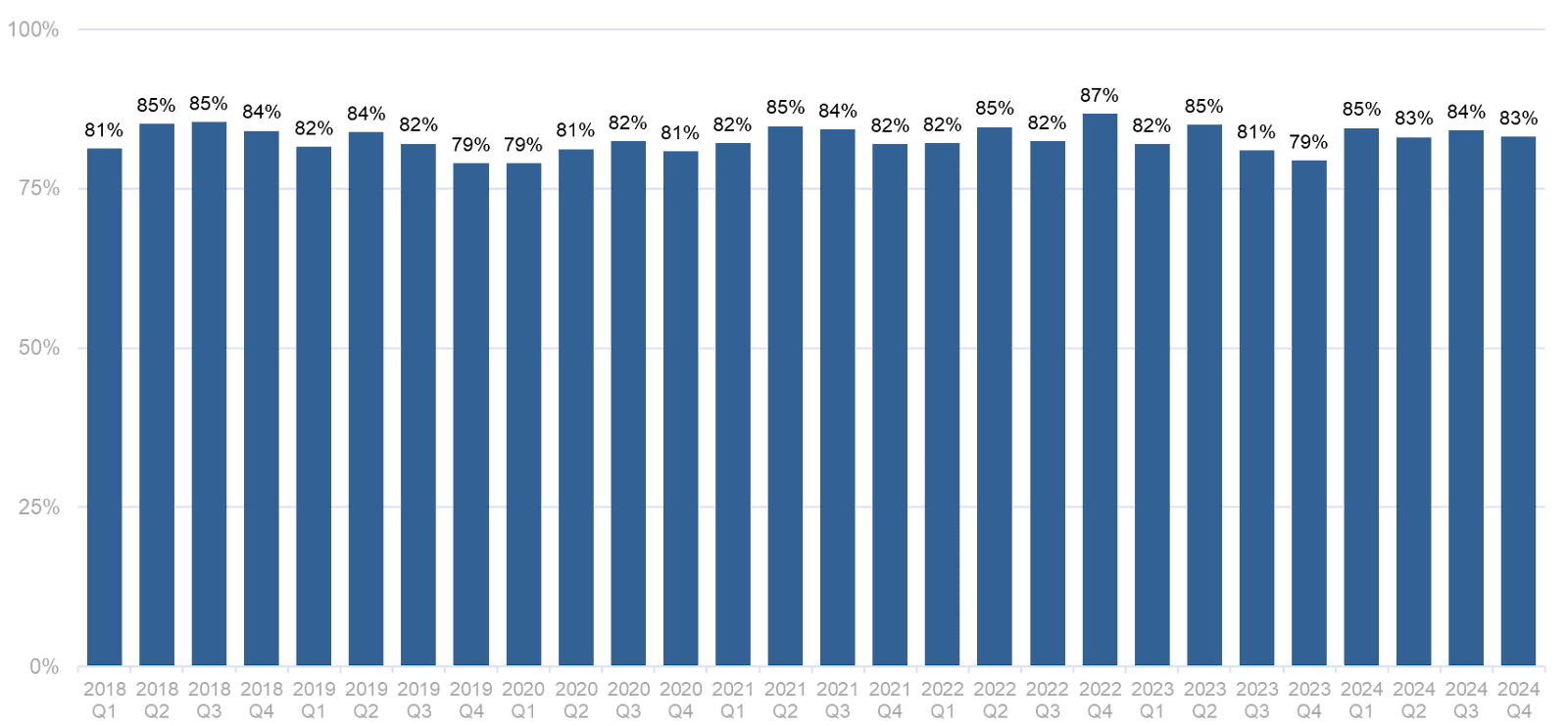

2. RENEWAL RETENTION RATES

Incumbents talk about intense competition from new players. We took a look:

Quarterly Retention Ratio

All Insureds, All Layers, 2018-2024

- Although there is much talk of demonstrating discipline, most business stays put. Even if new capacity is pressuring prices, nobody is stepping back.

We looked for differences in price changes by outcome – did the business stay or move?

Annual Price Change By Renewal Outcome

2018-2024

- In 2018 most insureds stayed with their carrier and renewed flat. Those who changed did so for a reason – some jumped, others were pushed.

- By 2020 the market correction was evident and changing carriers made little difference

- Since 2022, as the market has softened, so the difference in outcome has narrowed. Put another way, ongoing price reductions are widespread among incumbents and competitors alike

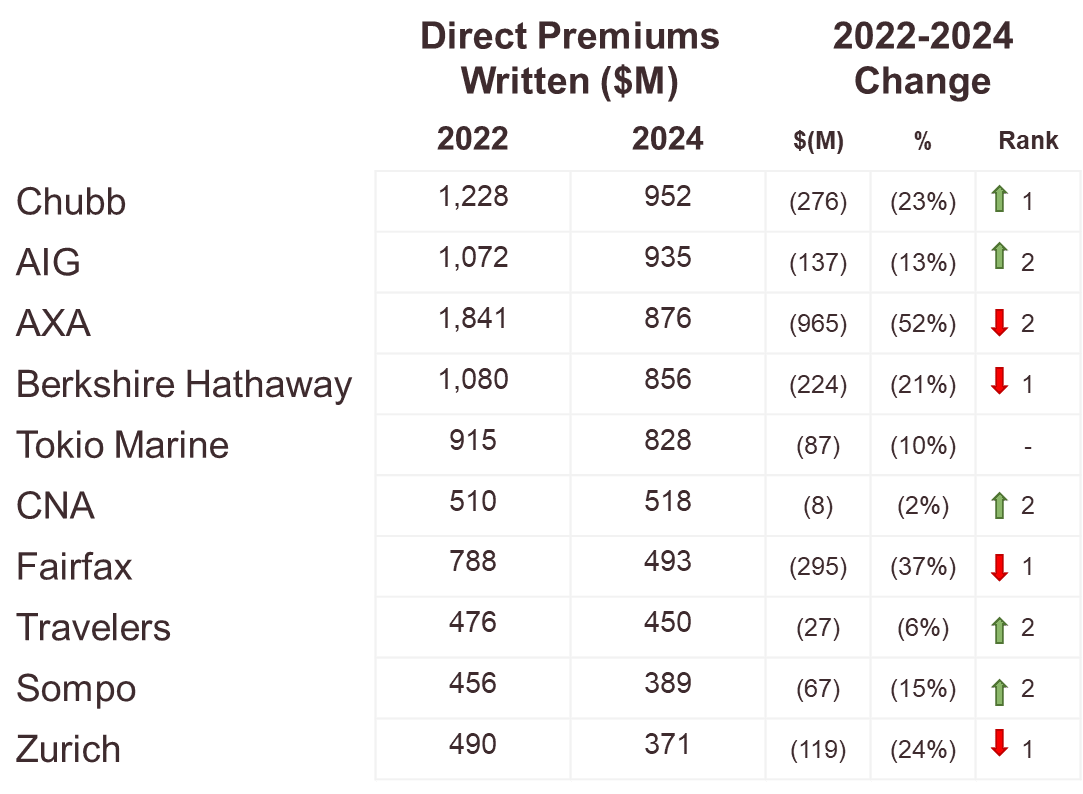

We used Schedule P’s D&O supplement to identify direct written premium changes among the biggest D&O writers over the past two years.

- There has been very little movement in the relative positions of top D&O writers

- Some have reduced premiums significantly, many have not

- Collectively, the datapoints suggest the premium reductions have been driven by price reductions rather than aggressive non-renewal of business

3. LOSS RATIOS

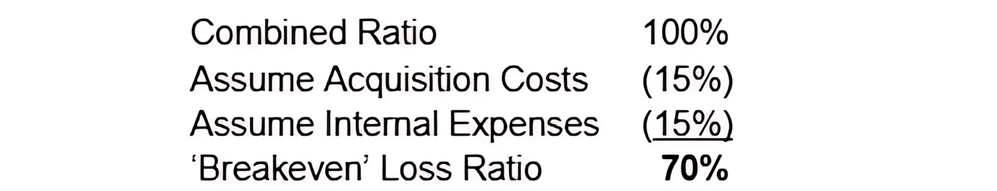

Our simplified profitability math remains the same:

How do results look against our math?

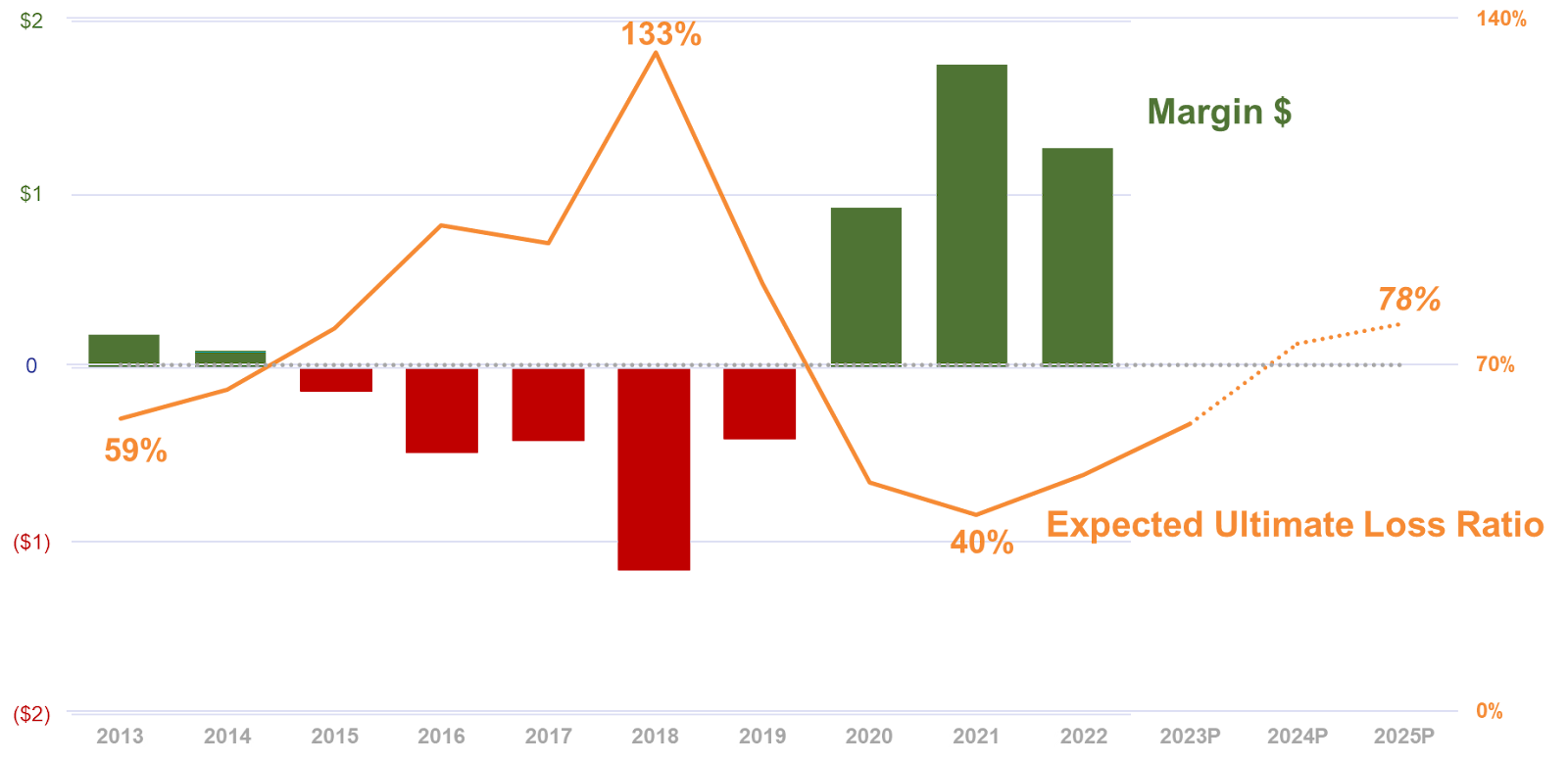

U.S. Commercial Public D&O Insurance

Expected Ultimate Loss Ratios and Margin $, 2013-2025 (TransRe Projected)

- We excluded FI, because it is Commercial pricing that is of most (current) concern

- ‘Margin$’ = GWP x {70%-expected ULR}

- 2019-2020 rate increases delivered positive results

- Subsequent price activity means ULRs are drifting back above ‘breakeven’

How have the results developed over time?

Industry Ultimate Loss Ratio Development By Accident Year

Schedule P, Other Liability Claims Made, 2015-2024

- 2016-2019 – the ‘older’ years continue to get worse

- 2020-2022 – more recent years continue to get better

- Initial picks for 2020-2021 were very conservative, at the height of pandemic concerns

The data does not support the contention that ‘we are giving away price, but we are still profitable’.

4. LOSS DRIVERS

To maintain an accurate and up-to-date view of D&O claim trends, we track both primary sources (securities class action filings) and secondary research (Stanford Law School’s Securities Class Action Clearinghouse, Cornerstone Research, Dowling Research, Bloomberg Law and Institutional Shareholder Services’ Securities Class Action Services). We split our case data between securities class actions and derivative suits and we add ‘latest filings of interest’. These are available upon request.

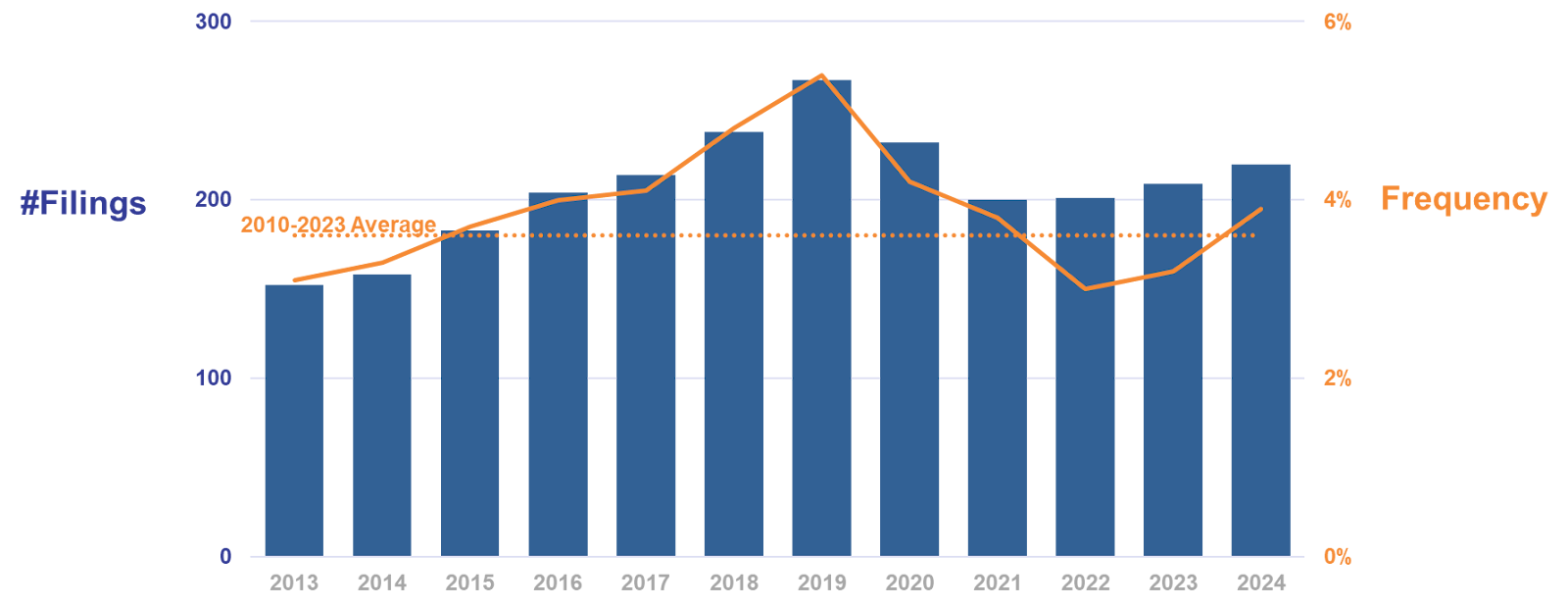

Loss ratios are the product of filing frequency and outcome severity:

Our frequency view excludes merger objections to focus on ‘core’ claims:

Legal Filings For ‘Core’ Claims

Ex. Merger Objection, 2013-2024

- Core filings are back above the long-term average

- With few new IPOs to increase the denominator, frequency follows filings

For a perspective on severity, Cornerstone Research’s just-published 2024 SCA Review notes that total settlement $ and the median settlement amount have both declined against 2023, but remain elevated compared to the past decade. The rationale for 2024’s drop includes:

- institutional investors were involved in fewer cases (smaller claims)

- more of the defendants also delisted and/or declared bankruptcy (fewer assets)

- more SPACs (which tend to settle for smaller amounts)

However, legal fee inflation remains elevated and, given recent filing trends (e.g. AI-related filings more than doubled from 2023 to 2024) and elevated levels of proxies for potential investor losses, Cornerstone expect settlement amounts to remain at ‘relatively high levels’ going forward. We don’t disagree.

The recent downward trend in frequency has halted, but not reversed, and severity shows little sign of easing. Losses remain a concern.

IN SUMMARY

Last August we saw early signs of an uptick in flat renewals. Was the tide turning? The latest evidence shows price drops have slowed but not yet stabilized.

Today our view is:

- 2019/2020 a necessary correction for prior year results and claim activity.

- 2021/2022 a temporary sweet spot. Rates rose while losses slowed.

- 2023/2024 giving back the profits the industry hadn’t even booked yet.

- 2025/2026 the outlook is unprofitable

A central banker once described the role as ‘taking away the punchbowl just when the party is really warming up’.

This is the time to take away the punchbowl.

About Our Database, Methodology, Sources

1. Over decades (and billions of premiums and corresponding claim payments) we have accumulated significant management and professional liability data and insights. We supplement this with licensed third party data and publicly available information, combined into our proprietary analytics engine.

2. Our database includes details of 30,000+ policies.

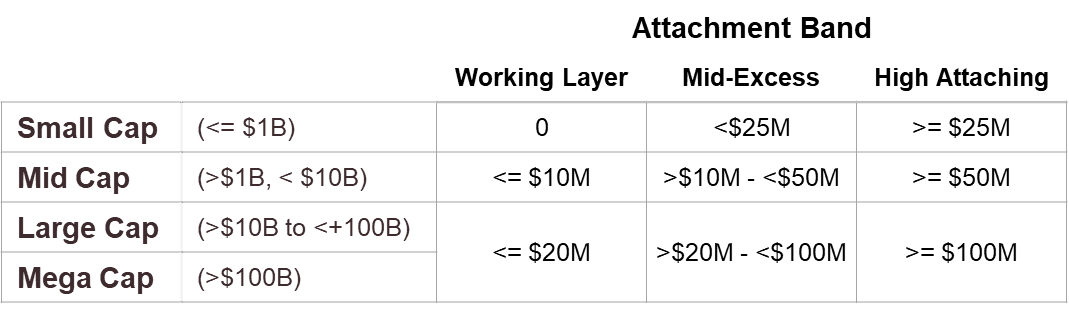

3. To deliver our analysis we separate Financial Institutions from Commercial, which we further sub-divide by company size and attachment point:

(Note the addition of Mega caps, consistent with analyses we share with clients).

4. We have focused on price rather than rate, to exclude (untrackable) changes in coverage.

5. In addition to general (CPI) inflation, we closely monitor two specific types of inflation which directly impact management liability:

a. Legal service inflation (LSI) which impacts loss adjustment expenses. According to the US Bureau of Labor Statistics) LSI was 4.9% in 2022, 6.3% in 2023 and 8.3% for 2024 (well above the 2015-2024 average of 4.3%).

b. Underlying loss cost trend (not just defense costs) which reflects increased severity as the plaintiffs’ bar pursues fewer but more likely cases and asks for more.

6. We only include the business we see. While we believe this to be a majority of what is available, it is not the entire market.

Sources

In addition to publicly available data and our own insights, our third-party data comes from a combination of FactSet, Stanford Securities Litigation Analytics, Stanford Law School Securities Class Action Clearinghouse, The D&O Diary, SNL and National Economic Research Associates (NERA), whose work we gratefully acknowledge. To maintain our claims database, we actively monitor major suits and their outcomes.

Contacts

To discuss any aspect of this report, or your ongoing U.S. Public D&O reinsurance needs, please reach out to any member of the production team:

Portfolio Management

Elise McKenzie

Anthony Matteo

Ben Casey

Underwriting

Daniel Hojnowski

George Delaney

Diana Liu

William Seymour

Mathew Yuen

Dierdre Zeppie

Lonny Agulnick (Fac)

Actuarial

Joe Marracello

Kevin Peterson

Claims

Seth Goldberg

You can also reach us at Communications@transre.com.

Legal

Reproduction in any form without permission of TransRe is prohibited.

The material and conclusions contained in this document are for information purposes only and TransRe offers no guarantee for the completeness of its contents.

Statements in this document may provide current expectations of future events based on certain assumptions. These statements involve known and unknown risks, uncertainties and other factors which are not exhaustive. Although TransRe makes reasonable efforts to obtain information from reliable sources, TransRe does not guarantee the accuracy or completeness of the information given or any forward-looking statements made.

TransRe undertakes no obligations to revise or update any statements, whether as a result of new information, future events or otherwise, and in no event shall TransRe or any of its affiliates or employees be liable for any damage or loss arising in connection with the use of the information relating to this document.

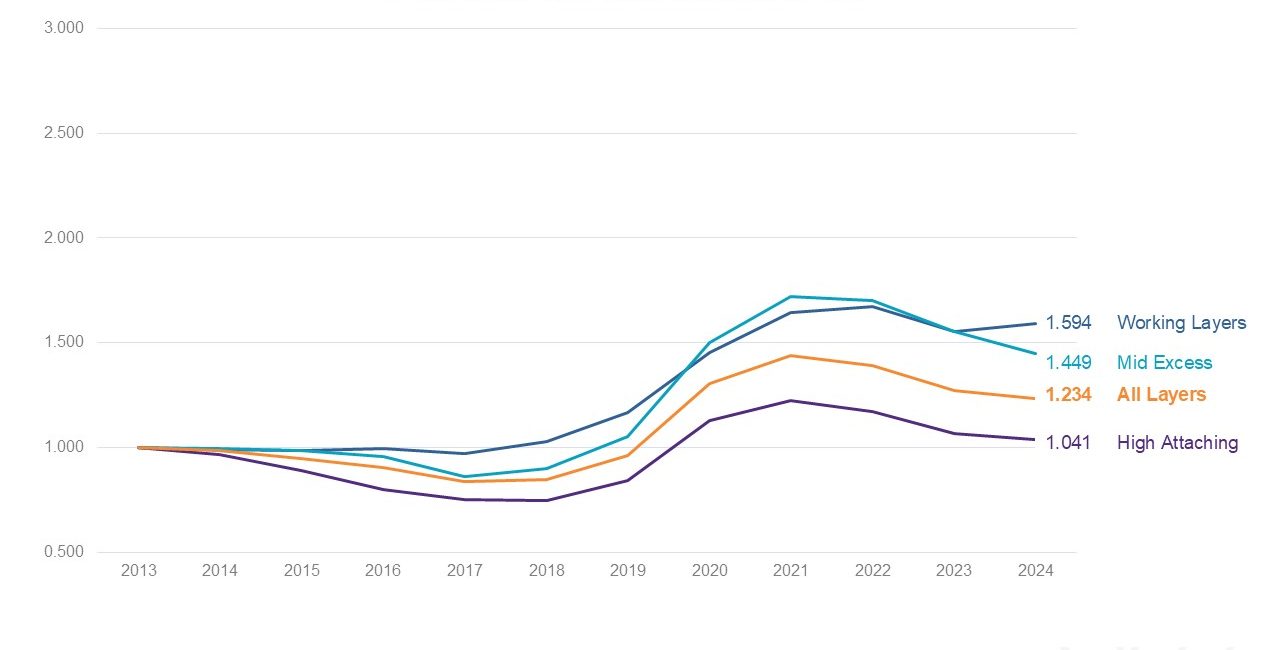

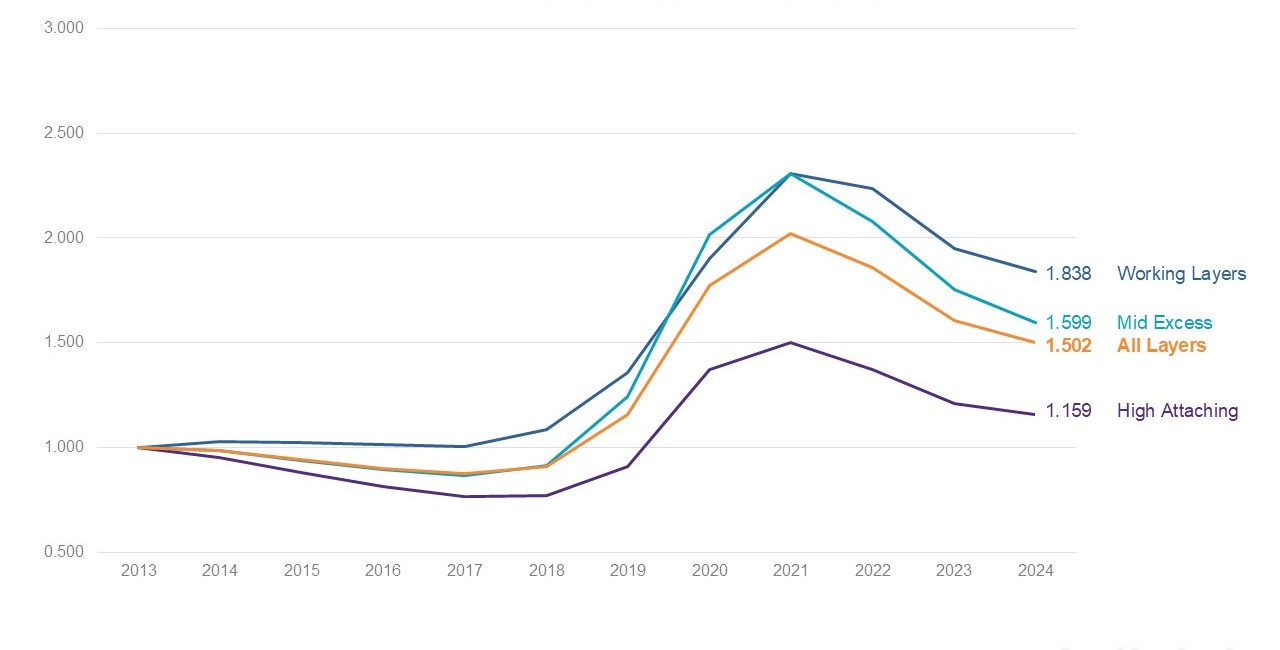

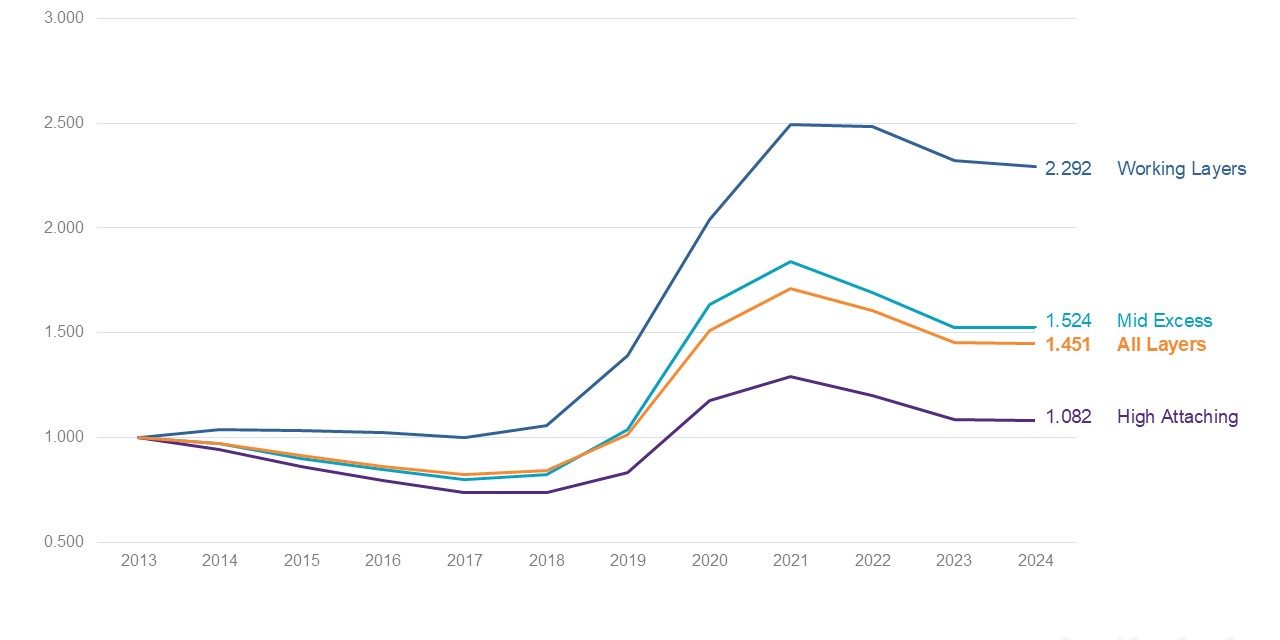

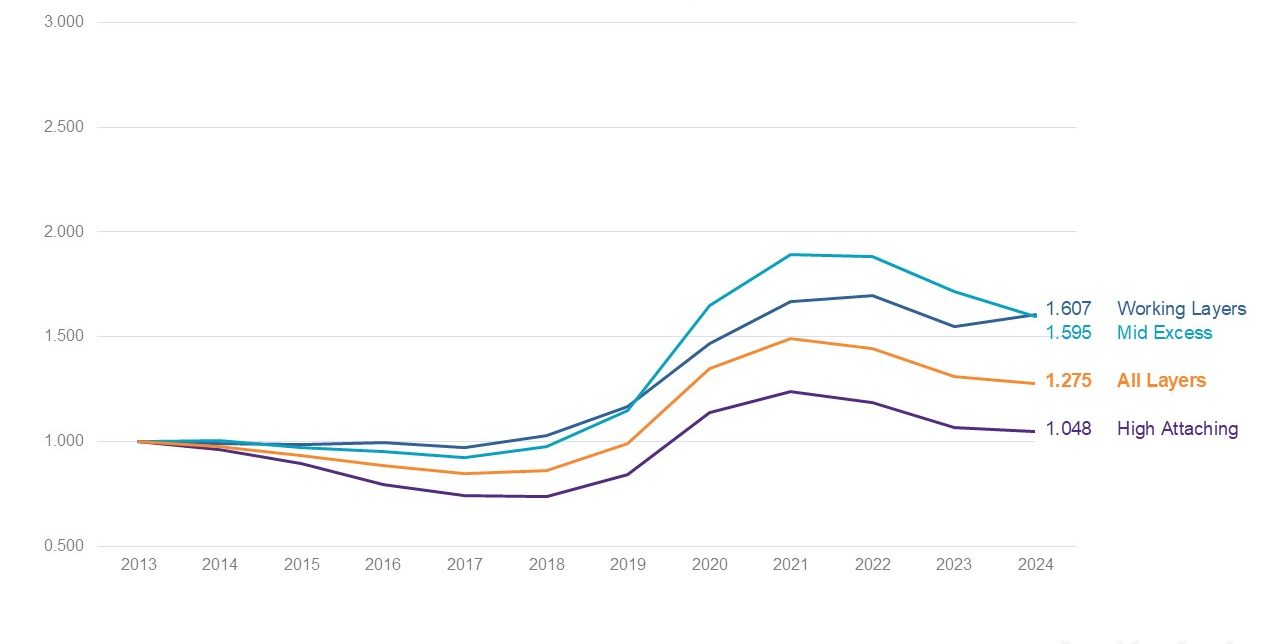

Appendix – Detailed Indices

All Policies

Small Cap, 2013-2024

Mid Cap, 2013-2024

All Policies, Large Cap, 2013-2024

All Policies, Mega Cap, 2013-2024

Commercial Only

All Insureds, By Layer, 2013-2024

Small Cap, 2013-2024

Mid Cap, 2013-2024

Large Cap, 2013-2024

Mega Cap, 2013-2024

Financial Institutions Only

All Caps, 2013-2024

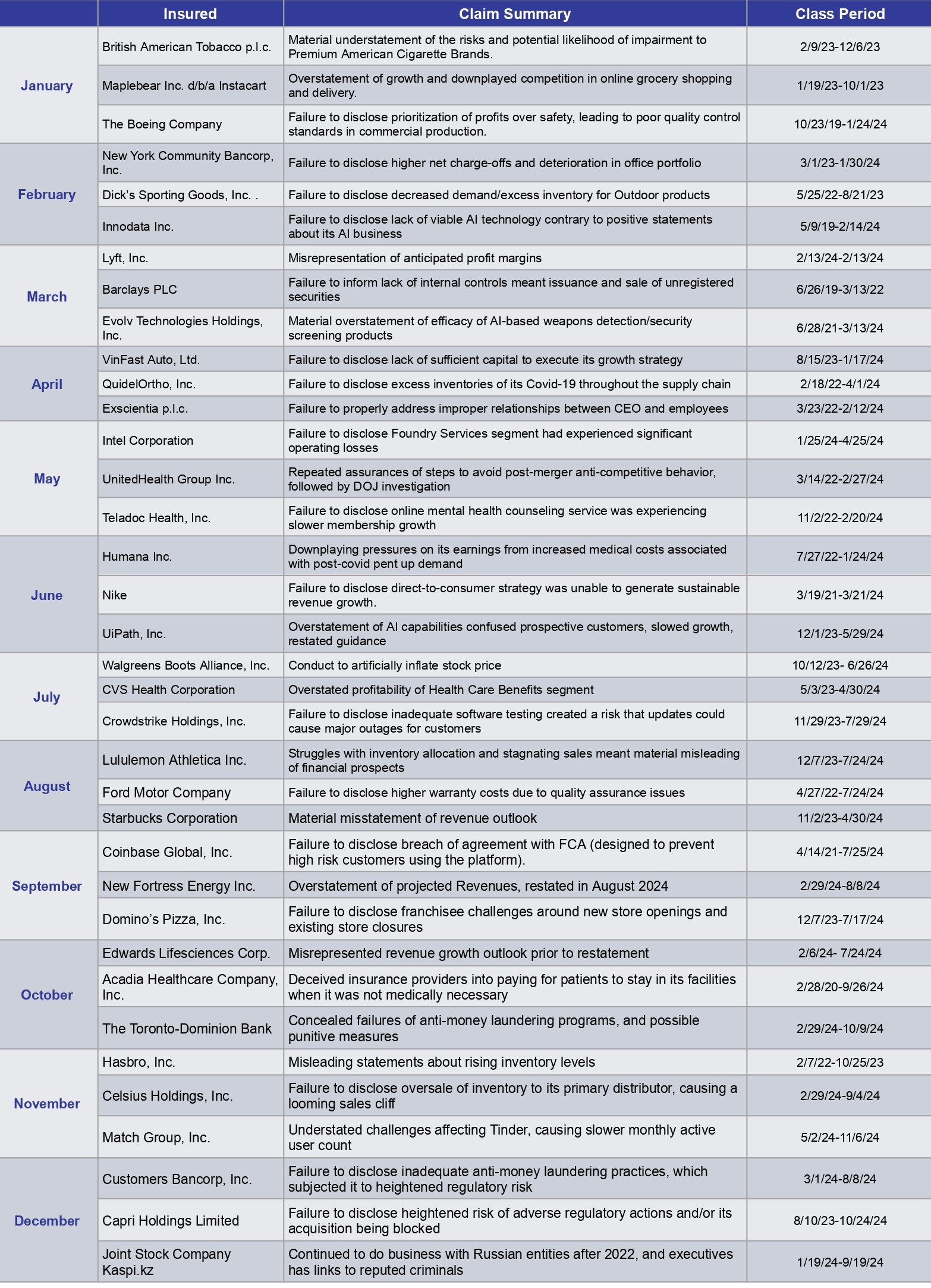

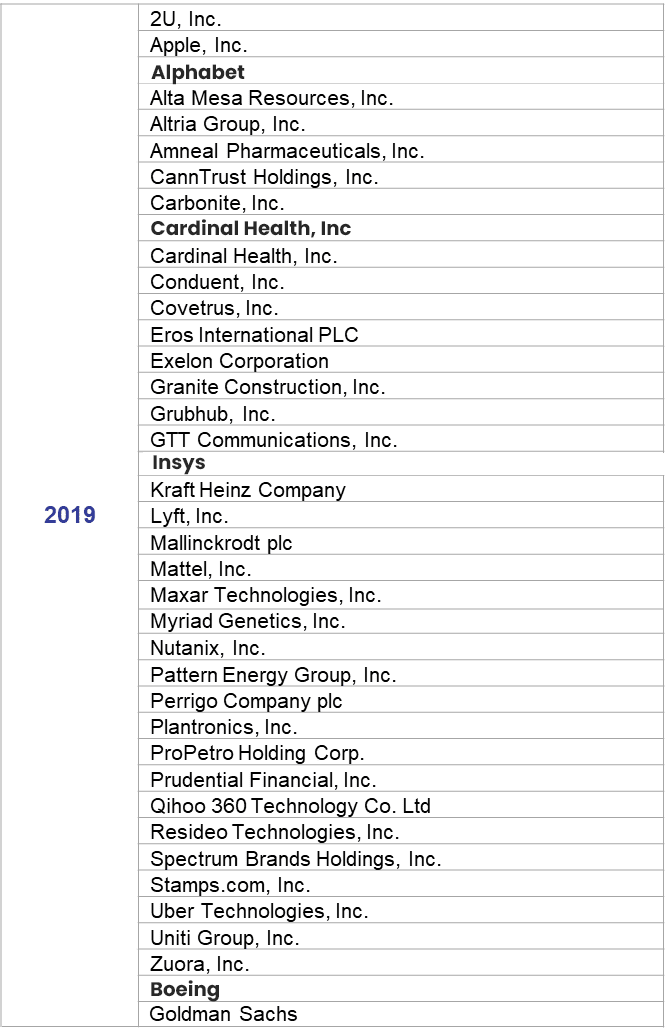

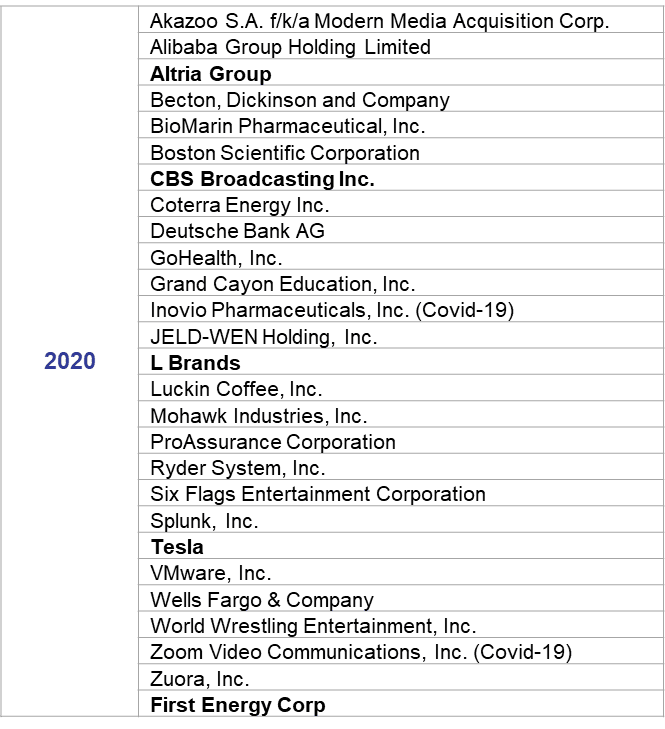

Appendix – SCA Claim Monitor

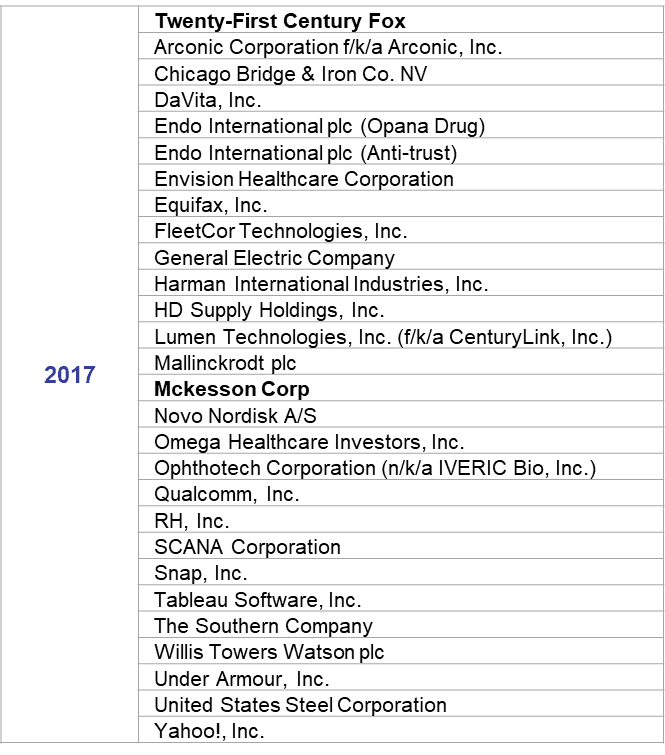

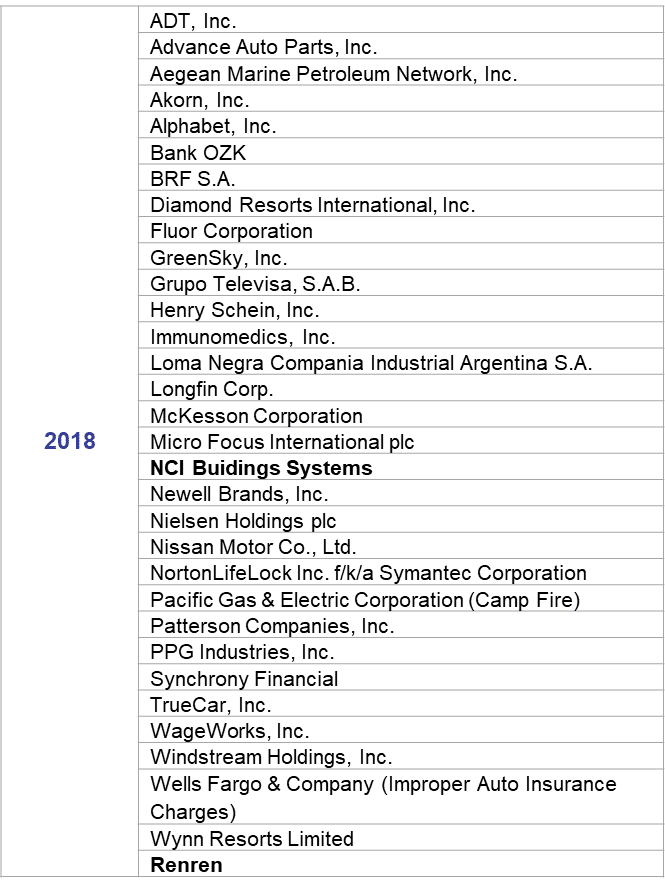

Appendix – Significant ($25M and above) D&O Settlements

By Year of Filing

Derivative suits are bolded – the balance are securities class actions.